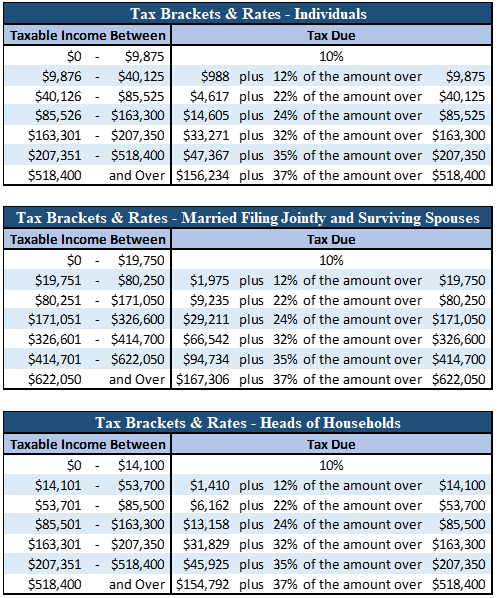

TurboTax Tip: Ordinary income is taxed at seven different rates: 10, 12, 22, 24, 32, 35 and 37 percent. For example, the brackets below show the first tax bracket if you are filing as single is from 0 to 9,950 with a tax rate of 10. Families will also benefit from the increase to phase‑out thresholds, as the maximum benefit begins to be reduced at a higher income level. In 2021 there are seven tax brackets with each one having a different tax rate ranging from 10 to 37. Benefit amounts will rise by as much as $121 for families with one child, $198 for families with 2 children, $260 for families with 3 children and $307 for families with 4 or more children. The ACFB was indexed by 6% on January 1, 2023. The benefit is distributed quarterly with payments in August, November, February and May. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets: 10, 12. The Alberta Child and Family Benefit (ACFB) provides direct financial assistance to lower-income Alberta families with children, with amounts increasing based on the number of children in the family (to a maximum of 4 children). The capital gains tax rate is 0, 15 or 20 on most assets held for longer than a year. The tax year 2022 maximum Earned Income Tax Credit amount is 6,935 for qualifying taxpayers who have three or more qualifying children, up from 6,728 for tax year 2021. Source: Treasury Board and Finance Child and family benefits The 2021 exemption amount was 73,600 and began to phase out at 523,600 (114,600 for married couples filing jointly for whom the exemption began to phase out at 1,047,200).

0 kommentar(er)

0 kommentar(er)